5 lakhs in his Personal Deposit Account (PDA/ C) as long as he avails of the scheme. (ii) An importer who has been extended the benefit of the scheme should maintain a minimum balance of Rs.

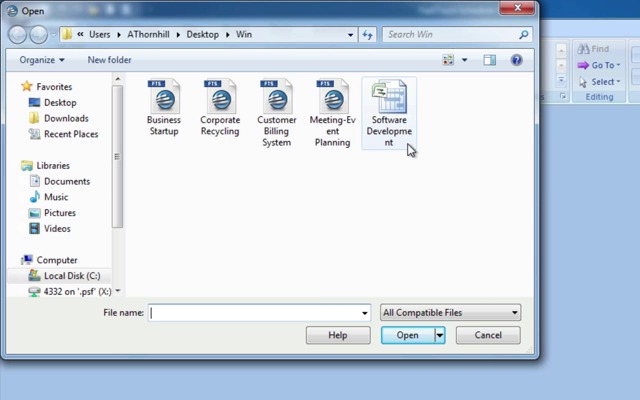

#Export fasttrack schedule to excel registration#

(i) An importer desirous of availing of the scheme shall file an application (Annex.II) with the concerned Custom House and obtain a registration number. (v) All goods falling under Chapter 86 of the Customs Tariff Act, 1975 (iv) Crude petroleum and petroleum products (ii) Bulk imports of sulphur, rock phosphate and coal The facility available under the scheme can also be extended to the following goods even when they are imported by any importer: Goods also Eligible for the Treatment Envisaged Under the Scheme

(ii) Goods which are enumerated in the list at Annexure I to this letter, (which list may be amended from time to time) except when they are imported by importers covered under A(i) toĬ.

other than cases where an LUT is prescribed / is required under the EXIM Policy and (I) Goods for which an import licence or the execution of a Bond and or Bank guarantee is required i.e. Importers who have been found to be involved in any proven case of fraud, forgery or suppression of facts, are, however, Not eligible to avail of the scheme. Major Custom House for this purpose would be – Seaports at Mumbai, Nhava-Sheva, Calcutta and Chennai and air cargo complexes at Sahar and Delhi and other Customs formations would be Kandla, Visakhapatnam, Cochin Ports, Chennai (Air Cargo), Cochin Bangalore (Air Cargo) and ICD at Tughlakabad. (vii) Manufacturer – importer of electronic goods having investment of Rs. (vi) Top 20 importers in terms of their duty payment in major Custom House and top 5 importers of other customs formations (v) Central Government approved Research Institutions and Test Houses (iv) All 100% EOUs including units in HTP and STP (iii) Units located in the various Export Processing Zones (ii) Public Sector Undertakings engaged in manufacture Only the following categories of importers would be eligible to avail of the scheme : The salient features of “Fast Track Clearance” scheme are as follows:. This scheme, apart from facilitating quick clearance of the goods imported by eligible importers, would have the way for redeployment of appraising staff in the more critical and sensitive areas.Ĥ. The scheme would be available initially at the sea ports of Mumbai, Chennai, Calcutta, Cochin, Kandla, Nhava-sheva, Visakhapatnam and the air cargo complexes at Delhi, Sahar, Chennai Calcutta, Bangalore and ICD at Tughlakabad, Delhi. Taking note of the above perception and the representation of trade interests to liberalise the procedure further, it has been decided by the Board to introduce a ‘Fast Track Clearance’ scheme for certain identified categories of imports. The procedure, as observed, has, however, been generally perceived to be restrictive in its application.ģ. A review of the working of these procedures has revealed that on account of several factors many importers have not been able to avail of the procedures or have preferred to observe the usual procedure for reasons of their own. 450/ 51/ 92-Cus.IV, dated 25.5.92 prescribing a self-assessment procedure for Government Departments, Public Sector Undertakings and other importers fulfilling certain conditions.Ģ. IV dated 10.6.94 prescribing a procedure for expeditious assessment and clearance of goods and Board’s Circular F. Your kind attention is invited to the Board’s circular letter F.No. Subject: ‘Fast track Clearance’ for goods imported by eligible importers. Central Board of Excise and Customs, New Delhi

0 kommentar(er)

0 kommentar(er)